Let's be honest, nobody enjoys chasing down late payments. It's an awkward, sometimes frustrating part of doing business. But a well-written payment reminder isn't just a demand for money; it's a professional nudge sent to clients about an upcoming or overdue invoice.

Getting this right is crucial for keeping your cash flow healthy, especially when you consider that a staggering over 87% of businesses deal with late-paying clients. The trick is to be clear and helpful, firm but polite, all without souring a good client relationship.

Why a Great Payment Reminder Email Matters

Turning the uncomfortable task of chasing payments into a standard, professional process is a game-changer. Think of it less as a confrontation and more as a strategic communication tool. It protects your finances while actually reinforcing the professional relationship you've built.

Protect Your Cash Flow

Cash flow is the lifeblood of any company. When payments don't come in on time, it puts a real strain on your ability to pay your own suppliers, cover payroll, or invest back into the business. A systematic approach to reminders makes a huge difference.

- Prevent Delays: A simple, friendly reminder sent before an invoice is due can work wonders. It’s a helpful nudge for busy clients who genuinely just forgot, stopping a payment from ever becoming late.

- Systematize Collections: Having a planned-out email sequence means no invoice gets forgotten. It creates a predictable, professional process that's efficient for your team and crystal clear for your clients.

- Reduce Administrative Burden: Manually tracking every single invoice is a massive time sink. Automating your reminders frees up you and your team to focus on more important work. For anyone juggling multiple clients and projects, getting started with LeadFlow Manager can help organize and automate these critical communications right away.

Maintain Professional Relationships

How you ask for money can make or break a client relationship. Come in too hot with a demanding tone, and you could lose a great client forever. On the other hand, a professional and understanding approach builds trust for the long haul.

Think of it this way: your reminder email is just another touchpoint for your brand. By being polite, clear, and genuinely helpful, you’re showcasing your professionalism. You aren't just demanding cash; you're making it easy for them to pay you. This means re-attaching the original invoice and including a direct payment link to remove any friction that could cause another delay.

Suddenly, the conversation shifts from a confrontation to a collaboration.

Staying on the Right Side of the Law with Payment Reminders

Before you even think about hitting “send” on a payment reminder, you need to get your head around the legal stuff. It’s not the most exciting part of running a business, but it’s absolutely critical. The rules for how you talk about payments, especially for subscriptions and recurring services, change a lot depending on where your customers live.

These aren't just gentle suggestions, either. They're serious consumer protection laws built to keep things transparent and fair. Messing this up can lead to some pretty hefty fines and, just as bad, a damaged reputation. Getting your reminder process legally sound from the get-go protects your business and shows customers you're trustworthy.

Your Disclosure Obligations: What You Have to Say

The core idea behind all these regulations is clear and conspicuous disclosure. You have to be completely upfront about the terms of your agreement, especially when automatic renewals are involved. This means your sign-up page and every payment reminder email have to be crystal clear.

You're typically required to spell out a few key things:

- Renewal Terms: State clearly that the service will auto-renew unless the customer actively cancels.

- Billing Frequency: Let them know exactly how often they'll be charged—monthly, annually, etc.

- Charge Amount: Disclose the precise cost of the upcoming renewal.

- Cancellation Method: Give them a dead-simple, easy-to-find way to cancel their service.

Think of your payment reminders as more than just a bill. They're a chance to transparently re-confirm the service terms. This kind of proactive communication is the foundation of ethical, compliant billing.

Some places are getting really strict about this. California, for example, has rolled out some of the toughest rules for subscription auto-renewals in North America, with major updates taking effect on July 1, 2025. These changes require businesses to send a clear payment reminder email every year for annual subscriptions. It has to spell out the service, the charge, and provide a simple cancellation link. The law also demands a 7 to 30-day notice for any price changes, making sure customers are never caught off guard. You can dive into the specifics of California's enhanced automatic renewal law on dglaw.com.

Practical Steps to Stay Compliant

So, how do you make sure you’re following the rules? It's time for a quick audit of your entire billing communication process. Start with your initial sign-up or service agreement. Are all the renewal terms laid out clearly before a customer ever gives you their credit card details?

Next, pull up your payment reminder email templates. Make sure they include all the legally required info and that you’re sending them within the proper timeframes, whether you’re guided by California's rules or regulations from the Federal Trade Commission (FTC).

Your mission here is to wipe out any chance of confusion. A compliant reminder doesn't just help you get paid on time—it proves to your customers that you're a business they can count on.

Writing Subject Lines That Actually Get Opened

Let's be honest. Your payment reminder is just one of a hundred emails landing in your client's inbox today. It's competing with everything from urgent project updates to their lunch order confirmation. If you use a weak, generic subject line like "Invoice" or "Payment Reminder," it's going straight to the bottom of the pile—or worse, the trash.

The subject line is your one shot to cut through the noise. It needs to be clear, professional, and give the recipient all the context they need to open it now. Think of it as the key that unlocks the door to getting paid.

Be Clear And Informative

Vagueness is the enemy of getting paid on time. You want your client to see the email and know exactly what it is, who it's from, and why it matters, all without even opening it. This isn't the time for creativity; it's the time for clarity.

The best subject lines I've ever used always include a few key details right up front:

- Your Company Name: This answers the "Who is this from?" question immediately.

- The Invoice Number: This is the golden ticket for their accounting team. It makes their job a thousand times easier.

- The Due Date: This creates a natural sense of timeliness and helps them prioritise.

So, instead of a forgettable "Invoice Due," try something like: [Your Company Name] Invoice #12345 Due [Date]. It’s direct, it’s professional, and it's impossible to misunderstand. You've instantly turned a nagging reminder into a helpful notification.

Adjust The Tone Based On Urgency

The tone of your subject line needs to change as the invoice gets older. A friendly heads-up won't work for a payment that's a month late, and a stern warning is overkill for an invoice that isn't even due yet.

A great subject line is a balancing act. It needs to be firm enough to prompt action but polite enough to preserve the client relationship. The key is to match your tone to the situation.

Here’s how I’ve seen this play out in the real world:

1. Before the Due Date (The Gentle Nudge) At this stage, your goal is to be helpful. You’re simply sending a courtesy notice.

- Subject: Friendly Reminder: Your Invoice #12345 is Due Next Week

- Subject: [Your Company Name]: A Quick Heads-Up on Invoice #12345

2. On or Shortly After the Due Date (The Polite Reminder) The tone gets a bit more direct here, but it’s still professional and assumes good intentions.

- Subject: Following Up on Invoice #12345 from [Your Company Name]

- Subject: Payment Reminder for Invoice #12345 Due [Date]

3. Well Past the Due Date (The Firm Alert) Okay, now it’s time to convey urgency. Using words like “Overdue” or “Action Required” sends a clear signal that this needs immediate attention.

- Subject: OVERDUE: Invoice #12345 from [Your Company Name]

- Subject: Action Required: Your Invoice #12345 is 30 Days Past Due

The Anatomy of an Effective Reminder Email

Writing a reminder email that actually gets you paid isn't just about demanding money. It’s about communication. The real goal is to build a clear, helpful, and totally frictionless experience that makes it incredibly easy for your client to pay you right away.

Think of each part of your email as having a specific job. From a polite opening to a professional sign-off, every element should guide the client toward clicking that "pay now" button. Once you get these components right, you'll have a reliable template that gets results without damaging your client relationships.

Start With a Human Touch

Your opening sets the tone for the entire message, so let's skip the robotic "Dear Sir/Madam." Instead, start with a simple, human greeting. A friendly line like, "Hope you're having a great week," immediately softens the conversation.

This small touch shows you see them as a person, not just an invoice number. It turns a potentially awkward request into a simple professional follow-up. Always assume the best, especially for the first reminder—they probably just forgot, and your email is a helpful nudge.

Essential Components of a Payment Reminder Email

To get paid quickly, you need to eliminate any guesswork for your client. The table below breaks down the must-have elements for every reminder you send, ensuring clarity and encouraging prompt action.

table block not supported

By including these key pieces of information, you give your client's accounting department everything they need in a single glance, making their job—and yours—much easier.

Clearly State the Essentials

This is the core of your email. Vague requests are a recipe for confusion and delays. Your client shouldn't have to dig through old records to figure out what you’re talking about, so present the key info upfront where it's impossible to miss.

Your email must include:

- The Invoice Number: This is the most crucial piece of information for their records.

- The Total Amount Due: State the exact balance clearly and boldly.

- The Original Due Date: Remind them when the payment was expected.

The single biggest mistake you can make is forcing the client to do any investigative work. Your reminder should contain all necessary information, removing every possible barrier to payment.

Make Payment Effortless

Once you’ve clearly stated what’s owed, your next move is to make paying as simple as humanly possible. Modern clients expect convenience. Forcing them to mail a cheque or hunt for banking details adds friction that only leads to more delays.

This is where a direct call-to-action becomes your best friend.

Include a big, obvious, clickable link that takes them straight to an online payment portal. Use clear, action-oriented text like "Pay Your Invoice Here" or "Settle Your Balance Now." This one simple addition can radically speed up your collection times. For businesses juggling complex client interactions, simplifying every step is crucial. You can learn more about streamlining these kinds of workflows by checking out these lead routing best practices to boost sales efficiency.

The Power of the Attachment

Always, always attach the original invoice as a PDF to your email. This is a non-negotiable best practice. Trust me. One of the most common reasons for late payment is that the original invoice got lost, landed in spam, or was sent to the wrong person in the first place.

By re-attaching it, you solve this problem before it even comes up. It instantly neutralizes the "I never got the invoice" excuse and gives their team all the details they need without having to send a follow-up email asking for it.

Finally, close your email on a helpful and professional note. A simple line like, "If you have any questions or there's an issue with this invoice, please don't hesitate to reply to this email," works wonders. It reinforces your professional stance and keeps the lines of communication wide open.

Creating a Strategic Reminder Schedule

If your collections "strategy" is just sending a single email and hoping for the best, you're not really strategizing—you're gambling. And it's a bet you'll often lose. A truly effective process hinges on a well-timed sequence of reminders that slowly dial up the firmness. This cadence keeps your invoice from getting buried in a busy client's inbox without making you look like a pest.

It’s a simple shift in mindset: stop thinking of these as one-off messages and start seeing them as a coordinated campaign. Each email has a specific job, from the gentle pre-due date nudge to the final, firm notice. This structure takes the emotion out of the equation, turning an awkward chore into just another standard business procedure.

The Pre-Emptive Strike: Your Friendly Nudge

Your first move should actually happen before the invoice is even due. This is my favourite trick in the book. A quick, friendly reminder sent about a week before the payment deadline is one of the most powerful tools you have. This isn't a demand for money; it's a simple courtesy.

This proactive email does a few things beautifully:

- It serves as a helpful prompt for clients who fully intend to pay on time but are juggling a dozen other things.

- It confirms they have the invoice and all the details they need to pay you. No excuses later.

- It gives them a perfect, low-pressure opportunity to flag any issues before the payment officially becomes late.

The whole point of this first email is to be helpful. By framing it as a friendly heads-up, you strengthen the professional relationship and stop a surprising number of invoices from ever becoming overdue.

The Due Date and Early Overdue Follow-Up

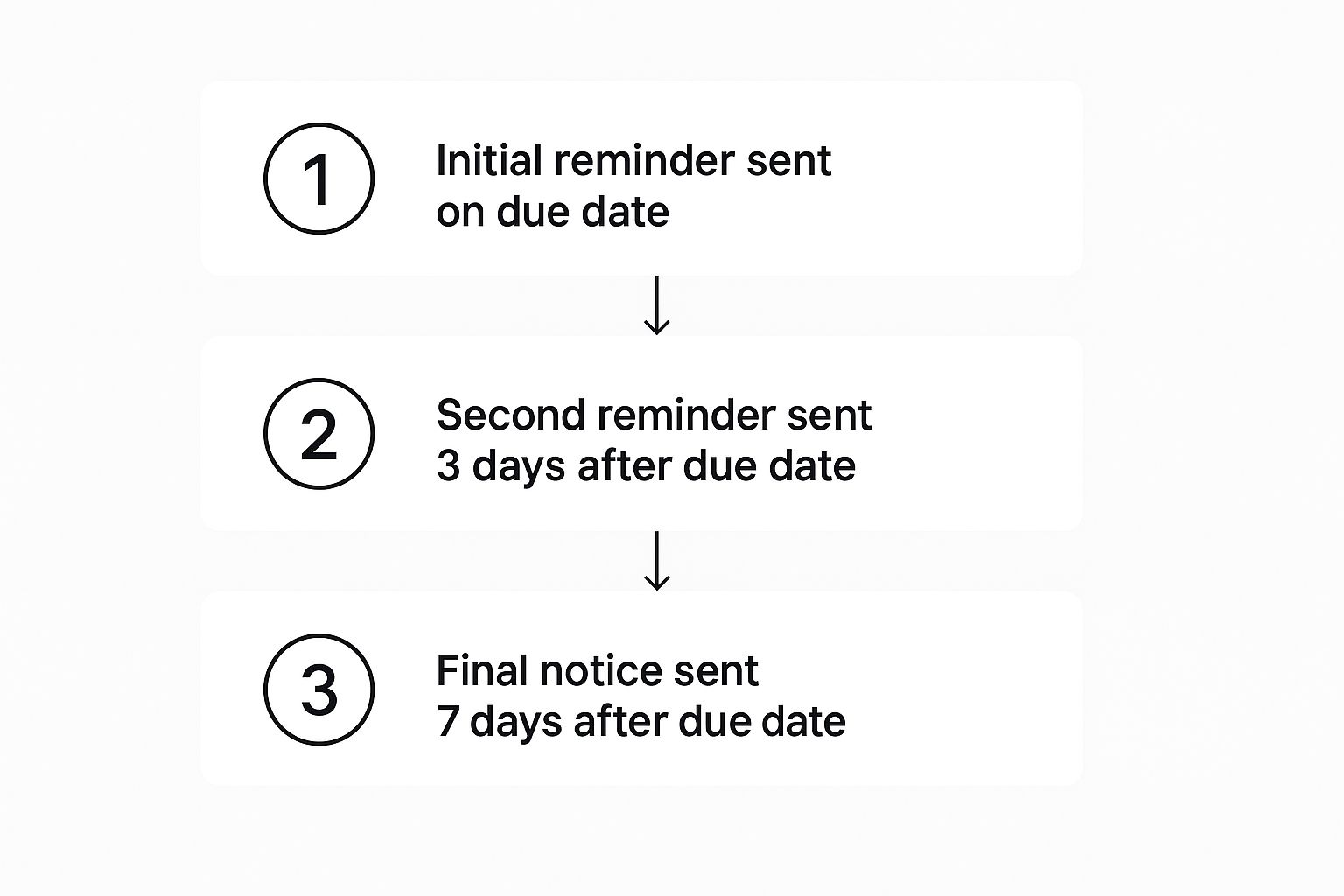

Once the due date hits, the tone of your communication has to shift, even if just slightly. If you haven't seen the payment come through, it’s time for a follow-up that’s a bit more direct, but still polite and professional. This next phase usually kicks off on the due date itself and continues at short intervals for the next week or so.

This is a pretty standard, and effective, flow for handling invoices as they become overdue.

As you can see, the tone escalates pretty quickly from a gentle reminder to a more serious notice, all within about a week of the payment becoming late.

A typical schedule at this point might look something like this:

- On the Due Date: A simple, "Just a friendly reminder that Invoice #12345 is due today."

- 3-5 Days Overdue: A slightly more direct email, "Following up on overdue Invoice #12345."

- 7-10 Days Overdue: The tone gets firmer here, pointing out that the payment is now over a week late.