It all boils down to a simple, crucial distinction: an invoice is a request for payment, whereas a receipt is proof of payment.

Think of it this way: an invoice is you asking to get paid for a job you've done. A receipt is the "thank you, got it" that confirms the money has landed in your account. Getting this right is the bedrock of solid financial management.

Invoice vs. Receipt: The Fundamental Difference

When you're handling business transactions, the words "invoice" and "receipt" get thrown around a lot, but they mark two completely separate points in the payment journey. An invoice is sent out before a client pays. It breaks down the products or services delivered and spells out exactly how much is owed, kicking off the accounts receivable process for your business.

A receipt, on the other hand, is created only after the payment has been made. It serves as the official confirmation for both you and your customer that the transaction is complete and the slate is clean. This piece of paper (or digital file) is essential for accurate bookkeeping, tracking expenses, and handling any future returns or warranty claims.

For a deeper dive into the mechanics of these documents, this comprehensive guide to mastering invoices and payments is a fantastic resource.

Invoice vs. Receipt At a Glance

To make it even clearer, here’s a quick table that lays out the core differences side-by-side.

table block not supported

At the end of the day, an invoice initiates a financial obligation, while a receipt closes it out. Both are non-negotiable for maintaining transparent and professional financial records.

How Invoices Drive Your Business Cash Flow

Think of an invoice as more than just a request for payment. It's the engine that powers your accounts receivable and the first step in turning your hard work into actual revenue. A polished, professional invoice doesn’t just ask for money—it clearly sets expectations and deadlines to keep your cash flow healthy.

For any business operating in Canada, getting the details right is non-negotiable. To be compliant with the Canada Revenue Agency (CRA), every invoice must include specific information like your business number, the date, a unique invoice number, and a detailed description of what you provided.

And, of course, you have to be precise about any Goods and Services Tax (GST) or Harmonized Sales Tax (HST) you've collected. Skipping these details isn't just sloppy; it can cause payment delays and a lot of administrative grief down the line.

Choosing the Right Invoice Type

Not all invoices are created equal, because not all transactions are the same. Knowing which type to use in different situations is key to maintaining clear financial records and running a smooth operation.

- Pro Forma Invoice: This is essentially a preliminary bill sent to a client before you start the work. It lays out the expected costs and scope, helping you get a client's commitment without officially logging it in your accounts receivable.

- Recurring Invoice: If you run a subscription-based service or have clients on a retainer, this is your go-to. These are set up to be sent out automatically at regular intervals, like the first of every month.

- Credit Note (or Credit Memo): Made a mistake on an earlier invoice? Need to cancel a charge or process a refund? A credit note is the proper document to issue, officially correcting the record.

Timing your invoices strategically and sending polite reminders are just as important as the invoice itself. For tips on how to handle follow-ups effectively, you might find our guide helpful: https://leadflowmanager.com/blog/writing-the-perfect-payment-reminder-email

The push toward digital is real. The Government of Canada has required its own suppliers to use e-invoicing since 2018, signalling a major shift for both B2B and B2G transactions. If you're waiting on payments and need to bridge a gap in your cash flow, it's also worth looking into invoice financing options that can help you access capital sooner.

Why Receipts Are Your Financial Bedrock

If an invoice is the request for payment, a receipt is the final word. It's the concrete proof that a transaction is officially done and dusted, making it an absolute must-have for any solid financial management plan.

For your business, that little piece of paper (or digital file) is the key to tracking expenses, handling warranty claims, and—most critically—staying compliant with your taxes. For your customers, it’s their ticket for returns, budget management, and simple proof of purchase. This two-way function makes it a vital document of trust and closure.

Trying to run a business without a proper system for managing receipts is like flying blind. You’re not just risking missed tax deductions; you could find yourself in a world of hurt during a Canada Revenue Agency (CRA) audit.

Essential Components of a Valid Receipt

For a receipt to hold up, especially for tax purposes here in Canada, it needs to tick a few specific boxes. If any of these details are missing, it might as well be a blank piece of paper in the eyes of an auditor.

- Supplier Information: The name and contact details of the business that sold the goods or service.

- Date of Transaction: The exact day the purchase happened.

- Detailed Description: A clear breakdown of what was bought, including quantities.

- Total Amount Paid: The final price, clearly showing any GST/HST that was paid.

Grasping the importance of receipts is just one part of smart financial management. It pays to dive deeper into efficient tax record keeping strategies to make sure you're always prepared.

Receipts and Your Bottom Line

How well you manage your receipts has a direct line to your profitability. Every single receipt for a legitimate business expense is a potential tax deduction, which lowers your taxable income.

Properly tracking these costs also helps you figure out the real return on investment for different parts of your business. To get a better handle on your numbers, you can use our free ROI tool at https://leadflowmanager.com/calculator to see exactly where your money is going. This turns receipts from simple records into powerful tools for protecting your profits.

Comparing Transaction Roles, Purpose, and Timing

While invoices and receipts are both essential financial documents, they sit on opposite ends of a transaction. Getting their purpose and timing right is fundamental to managing your sales cycle and keeping your books clean. Simply put, an invoice kicks off the payment process, and a receipt officially closes it.

Think about a service business, like a marketing agency. After hitting a project milestone, they'll send an invoice to formally request payment for the work they’ve done. This document starts the clock on their accounts receivable. Now, contrast that with buying a coffee. You get a receipt the second your card is charged, confirming the deal is done. The business model dictates the flow.

Pre-Payment vs. Post-Payment Documents

The fundamental difference is all about timing: an invoice is a pre-payment tool, while a receipt is a post-payment confirmation.

- Invoice (Pre-Payment): This is your forward-looking document. It lays out what a customer owes you and the terms for paying it, acting as a formal notice that a financial obligation exists. It’s the trigger for your customer's accounts payable department.

- Receipt (Post-Payment): This document looks backward. It serves as the official record that a debt has been paid, closing the loop on the transaction for both you and your customer.

This process has only become more important as businesses have moved to digital documents. The e-invoicing market is set to grow significantly, driven in part by governments wanting to make financial reporting more efficient. For a deeper look at this global shift, you can find detailed insights in this report on the global e-invoicing journey. This trend just goes to show how vital accurate and timely invoicing is today.

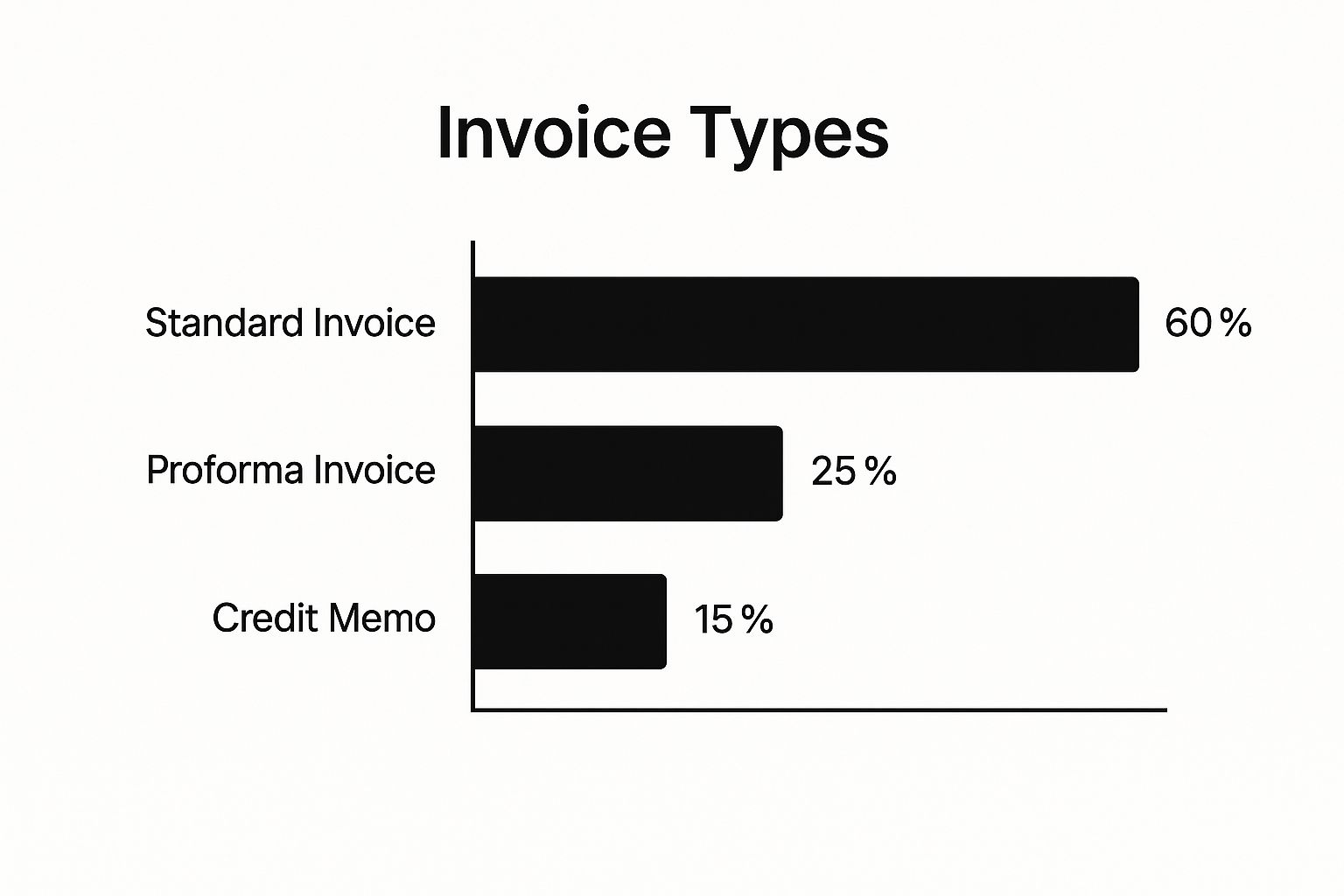

This chart breaks down the common types of invoices that businesses use to manage what they're owed.

As you can see, standard invoices are the backbone of most transactions. However, other documents like proforma invoices and credit memos have specific, important jobs in setting client expectations and fixing financial records. Confusing an invoice with a receipt isn't just a small slip-up; it can confuse your customers, hold up payments, and create some serious bookkeeping headaches down the road.

Streamlining Your Workflow with Modern Business Software

Let’s be honest: manually creating an invoice, chasing the payment, and then generating a receipt is a tedious process. It’s not just time-consuming; it's a minefield for human error. This is where modern business software, like a dedicated CRM or an accounting platform, completely changes the game by turning a fragmented, manual task into a smooth, automated sequence. Getting this right is about more than just efficiency—it’s about maintaining a professional image.

For field sales teams, this kind of integration is a massive advantage. Imagine your sales rep closing a deal on-site. They can generate a quote right there, and once the customer gives the nod, convert it into a professional invoice with a single click. This speed closes the gap in the sales cycle and gets the payment process rolling immediately.

The Automated Transaction Lifecycle

The real magic happens when these systems talk to each other. The moment an invoice gets paid—whether through an online portal or a mobile card reader—the platform can kick off a series of actions automatically. This builds a reliable and efficient financial backbone for your business.

Here’s what that automated workflow looks like in practice:

- Quote to Invoice: A sales quote is accepted by a client and instantly flipped into a detailed invoice. No one has to re-enter a single piece of information.

- Automated Delivery: The new invoice is immediately emailed to the client, laying out the payment terms clearly and providing a direct link to a payment portal.

- Payment Confirmation: The client pays the invoice online. The system instantly registers the payment and marks the invoice as paid in your accounts.

- Receipt Generation: A receipt is automatically created and sent to the customer, giving them immediate proof of their payment.

- Record Logging: The entire transaction, from the initial quote to the final receipt, is logged in the customer’s record. This creates a flawless audit trail for you and your client.

This level of organization is invaluable for any business, whether you’re in e-commerce, professional services, or field sales. It guarantees the distinction between an invoice or receipt is handled correctly every single time, keeping your financial records accurate and compliant.

For businesses ready to put these systems in place, the initial setup is everything. If you're looking to bring this level of efficiency to your sales process, you can find practical advice on getting started with LeadFlow Manager. This kind of automation frees up your team to focus on what they do best—building relationships and closing deals—instead of getting bogged down in paperwork.

Frequently Asked Questions

Even when you know the difference between an invoice and a receipt, real-world situations can get a little murky. Let's tackle some of the most common questions that come up for Canadian business owners, so you can handle them like a pro.

Can One Document Be Both an Invoice and a Receipt?

Sometimes, yes—but context is everything. This usually only happens when a customer pays for something on the spot, like at a retail store or a coffee shop.

The detailed sales slip you get lists what you bought and how much it cost (like an invoice) but also confirms you've paid (like a receipt). These are often called "Sales Receipts."

For most other business, especially in B2B or service-based industries where you offer payment terms like Net 30, you must keep them separate. You issue the invoice to ask for the money, and then you send a receipt only after the payment has cleared.

What if I Accidentally Send a Receipt Instead of an Invoice?

Sending a receipt before you've been paid is a recipe for confusion and can seriously delay getting your money. A receipt signals the deal is done and dusted. Your client might think they've already paid or that no payment is needed at all.

Think about it from their perspective: they have no formal "bill" to submit to their accounts payable department. Your payment request ends up in limbo, and your cash flow takes the hit.

Do I Really Need to Keep Both Invoices and Receipts for Taxes?

Absolutely, 100%. When the Canada Revenue Agency (CRA) looks at your books, these two documents tell very different parts of your financial story.

- Invoices are there to back up your income. They prove what you billed clients and represent the money flowing into your business.

- Receipts are your proof for business expenses. Every time you buy something for your company, that receipt is what lets you claim it as a deduction.

Without a complete set of both, you're telling an incomplete story. Invoices prove your revenue, and receipts justify your expenses. Diligent record-keeping isn't just about being organized; it’s fundamental to staying compliant and ensuring you get all the deductions you're entitled to. This clear separation is at the heart of knowing when to use an invoice or receipt.

Ready to stop juggling messy spreadsheets and missed follow-ups? LeadFlow Manager provides an all-in-one CRM that automates your sales workflow from lead capture to final sale, giving you complete visibility over your field sales operations. Streamline your sales process today!