As a contractor, getting paid on time is critical for maintaining cash flow and growing your business. But a generic invoice just won't cut it. The right invoice format not only ensures you get paid promptly but also builds client trust, protects you from scope creep, and clarifies project expectations. A poorly crafted invoice can lead to payment delays, disputes, and damaged client relationships. It's more than a request for payment; it’s a key communication tool that reflects your professionalism and attention to detail.

This guide moves beyond simple templates to provide a strategic breakdown of 7 essential invoice examples for contractors. We'll analyse each type, from standard Time & Materials to complex Progress Payments, offering actionable insights and replicable methods to help you create professional, effective invoices that secure your hard-earned revenue. You will learn not just what to include, but why specific layouts and details matter for different project types. Let’s transform your billing process from a necessary chore into a powerful business asset that reinforces your value and gets you paid faster.

1. Time and Materials (T&M) Invoice

A Time and Materials (T&M) invoice is a billing method where clients are charged for the actual hours of labour plus the cost of materials used for a project. This format offers complete transparency, making it one of the most common and trusted invoice examples for contractors, especially when a project's scope is unpredictable.

This model is ideal for projects where it's difficult to estimate the total cost upfront. Think of a home renovation that might uncover hidden structural issues, or repair work where the full extent of the damage is only revealed once the work begins. The T&M invoice provides the flexibility to adapt to these changes while ensuring you are fairly compensated for all work performed.

Strategic Breakdown

The core strategy behind a T&M invoice is risk mitigation and transparency. By billing for actual costs incurred, you transfer the risk of unforeseen complexities to the project itself rather than absorbing it through a fixed-price bid. This builds client trust, as they see exactly what they are paying for.

For contractors using a Time and Materials billing method, accurate estimation of raw material costs is fundamental for transparent invoicing. Tools like material cost prediction tools can help ensure precise charges.

Actionable Takeaways for Implementation

To implement T&M invoicing effectively, focus on meticulous record-keeping and clear communication:

- Utilise Time-Tracking Software: Use apps like QuickBooks Time to create detailed, accurate logs of all labour hours. This eliminates guesswork and provides irrefutable data.

- Document Everything with Photos: Take before, during, and after photos of the work. Visual evidence is powerful and helps clients understand the progress and necessity of specific tasks.

- Set Material Thresholds: Get pre-approval from clients in writing for any material purchases that exceed a predetermined cost. This prevents surprises and ensures everyone is aligned on the budget.

- Provide Regular Updates: Send weekly progress summaries alongside partial invoices to keep the client informed. This proactive communication helps manage expectations and prevents "invoice shock" at the project's conclusion.

2. Fixed-Price Contract Invoice

A Fixed-Price Contract invoice, also known as a lump-sum invoice, is a straightforward format where clients are billed a single, predetermined amount for an entire project. This approach is built on a detailed contract that outlines a precise scope of work, deliverables, and a payment schedule, often tied to project milestones. It's one of the most common invoice examples for contractors managing projects with minimal variables.

This model is perfect for projects where the scope is clearly defined and unlikely to change, such as new home construction with set floor plans or a commercial build-out based on detailed architectural drawings. It provides clients with cost certainty and simplifies budgeting, as the price is locked in before any work begins. For the contractor, it offers the potential for higher profit margins if the project is managed efficiently.

Strategic Breakdown

The core strategy behind a fixed-price invoice is predictability and scope control. By agreeing on a total cost upfront, you eliminate budget surprises for the client and set clear expectations for deliverables. This requires an extremely accurate and detailed initial estimate, as any cost overruns or miscalculations will directly impact your profitability. The burden of risk for unforeseen issues falls squarely on the contractor.

This model incentivizes efficiency. The faster and more cost-effectively you can complete the work to the specified standard, the greater your profit. It’s crucial to have a robust change order process in place to handle any client requests that fall outside the original, tightly defined scope.

Actionable Takeaways for Implementation

To use fixed-price invoicing successfully, you must master project definition and client communication:

- Create an Ironclad Scope of Work (SOW): Your contract must meticulously detail every task, material specification, and deliverable. Clearly state what is not included to prevent scope creep.

- Establish a Milestone Payment Schedule: Tie payments to the completion of specific, verifiable project phases (e.g., foundation complete, framing up, drywall installed). This improves your cash flow and demonstrates progress to the client.

- Implement a Formal Change Order Process: Any request that deviates from the original SOW must be documented in a written change order. This document should detail the new work, its cost, and the impact on the project timeline, and it must be signed by the client before work proceeds.

- Document Progress with Photos: Use photos and videos to document the completion of each milestone. This visual proof is invaluable for justifying milestone invoices and provides a clear record of your work quality.

3. Progress Payment Invoice

A Progress Payment invoice is a specialized billing format used for long-term, large-scale projects where payment is made in installments as work is completed. This method ties payments directly to milestones or the percentage of work finished, ensuring consistent cash flow for the contractor and allowing the client to pay for tangible results. It is a standard among invoice examples for contractors in commercial construction, government contracts, and phased residential developments.

This model is ideal for projects that span months or even years, where a single final payment would be financially unfeasible for both parties. Think of a multi-storey office building construction or a public infrastructure project. The invoice, often following standards set by the American Institute of Architects (AIA), provides a detailed accounting of work completed to date, materials stored on-site, and retainage, which is a portion of the payment held back until the project is fully completed to the client's satisfaction.

Strategic Breakdown

The core strategy of a Progress Payment invoice is financial management and risk distribution. By billing incrementally, contractors can cover ongoing labour, material, and overhead costs without depleting their capital. For clients, this approach minimizes the risk of paying a large sum upfront for work that has yet to be completed, aligning their expenditure with demonstrable project advancement.

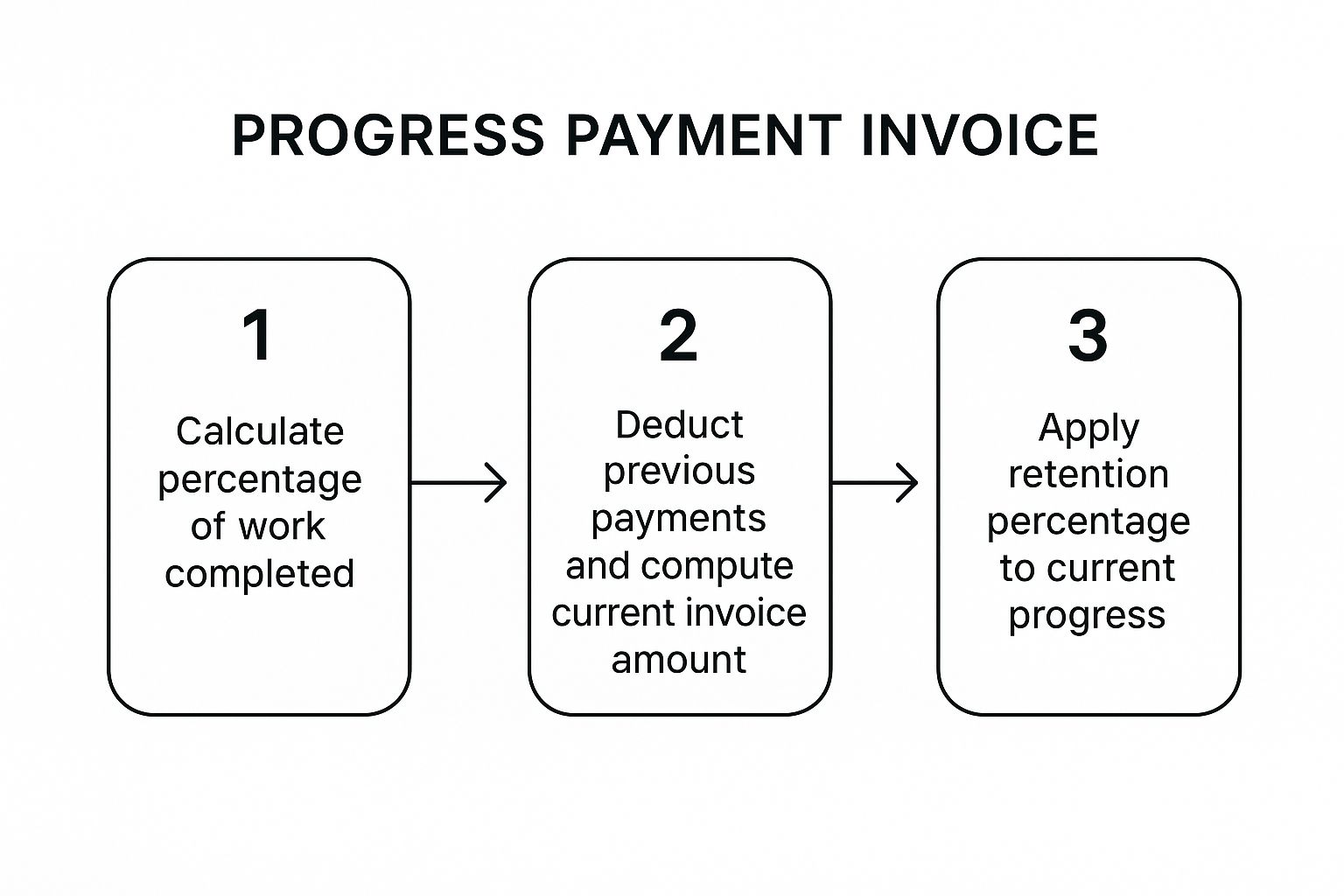

The process involves calculating the value of completed work, deducting previous payments, and applying a retention percentage. This workflow ensures that each payment request is transparent and justifiable.

This structured calculation provides a clear, auditable trail of project finances, building client confidence and simplifying budget management.

Actionable Takeaways for Implementation

To implement Progress Payment invoicing effectively, you need rigorous documentation and collaborative verification:

- Use Construction Management Software: Tools like Procore or BuilderTREND automate the creation of payment applications, track progress against the schedule of values, and manage retainage, significantly reducing administrative errors.

- Maintain Detailed Photo Documentation: Systematically photograph all completed work corresponding to each billing period. This visual evidence is crucial for verifying progress and resolving any disputes quickly.

- Schedule Regular Site Visits with Clients: Conduct joint walk-throughs with the client or their representative before submitting each invoice. This collaborative verification ensures agreement on the percentage of work completed and prevents payment delays. Explore some top progress report sample templates to see how this documentation can be structured.

- Keep Meticulous Records of Stored Materials: Accurately track materials purchased and stored on-site but not yet installed. Many contracts allow you to bill for these items, which can greatly improve your project's cash flow.

4. Unit Price Invoice

A Unit Price invoice is a billing format where contractors charge clients based on a predetermined rate for a specific quantity of work performed. This method is highly effective for projects with repetitive tasks or where the total volume of work can vary, offering a clear and scalable pricing structure.

This model is ideal for jobs like excavation billed per cubic metre, flooring installation charged per square foot, or roofing priced per square of material. The Unit Price invoice provides both the contractor and client with a straightforward way to calculate costs based on measurable outputs, simplifying the billing process for large-scale or quantity-dependent projects.

Strategic Breakdown

The core strategy behind a Unit Price invoice is standardisation and scalability. By breaking a large project down into measurable units with fixed prices, you create a transparent, predictable billing system. This approach minimises disputes over scope and allows for easy adjustments if the quantity of work changes during the project.

For contractors who offer services measured by area or volume, precision is crucial. Accurate measurements directly impact billing and profitability. Using reliable digital measuring tools can significantly improve the accuracy of these invoices and build client confidence.

Actionable Takeaways for Implementation

To implement Unit Price invoicing effectively, focus on precision in measurement and clarity in your agreements:

- Document Measurement Methods: Clearly state in your contract how units will be measured (e.g., linear feet, square metres, cubic yards). This prevents any post-project disputes about the calculation methodology.

- Provide Quantity Takeoff Sheets: Attach detailed takeoff sheets to your invoice. These documents show the exact calculations used to arrive at the final quantities, offering complete transparency.

- Conduct Joint Measurements: Whenever possible, take initial or final measurements with the client or their representative present. This shared verification process creates immediate agreement and reduces the chance of payment delays.

- Use Digital Measuring Tools: Employ laser measures, drone mapping, or software-based takeoff tools for superior accuracy and a professional presentation. This modernises your process and reinforces your credibility.

5. Emergency/Service Call Invoice

An Emergency/Service Call invoice is a specialized format designed for urgent, unscheduled, or after-hours work. This document itemizes charges that reflect the immediate and often disruptive nature of the service, such as premium labour rates, minimum service call fees, and diagnostic charges, making it a crucial tool among invoice examples for contractors in responsive trades.

This invoice type is essential for services where immediate action is required to prevent further damage or restore critical systems. Think of a plumber fixing a burst pipe in the middle of the night, an electrician restoring power during a storm, or an HVAC technician repairing a furnace in sub-zero temperatures. The invoice structure justifies the higher costs associated with mobilizing resources on short notice.

Strategic Breakdown

The core strategy behind an Emergency/Service Call invoice is value-based pricing and immediate revenue capture. You are not just billing for time and parts; you are billing for immediate availability, specialized skills under pressure, and the logistical cost of dispatching a technician outside of normal business hours. This model ensures profitability for high-stakes, on-demand services.

Clear communication of these premium rates before work begins is vital. This approach aligns client expectations with the financial realities of emergency response. Effective management of these urgent jobs, from dispatch to payment, is streamlined with a robust field service CRM. For more on this, you can learn more about CRM for field service on leadflowmanager.com and how it enhances operational efficiency.

Actionable Takeaways for Implementation

To effectively implement emergency invoicing, focus on transparency and operational readiness:

- Communicate Emergency Rates Upfront: When the client calls, clearly state the emergency call-out fee, the hourly rate, and any potential minimum charges. Document this conversation in your job notes.

- Establish Emergency Terms: Include a specific clause in your standard service agreement that outlines your emergency service policies and pricing. This sets a contractual foundation.

- Leverage Mobile Invoicing Apps: Use a mobile app to generate and send the invoice on-site immediately after the work is completed. This capitalizes on the client's relief and gratitude, leading to faster payments.

- Itemize Every Charge: Separately list the standard labour, the "After-Hours Premium" or "Emergency Surcharge," the cost of parts, and the initial diagnostic fee. This detailed breakdown prevents disputes by showing exactly what the client is paying for.

6. Subcontractor Invoice

A subcontractor invoice is a specialized billing document used by contractors who are hired by a general contractor (GC) or prime contractor to perform a specific portion of a larger project. This format is distinct because it must often adhere to the prime contract's terms, including specific formatting, compliance documentation like lien waivers, and detailed breakdowns that align with the GC's payment application system.

This invoice model is essential for any tradesperson operating within a larger project hierarchy, such as an electrical subcontractor on a commercial build or a specialty plumbing crew on a residential development. The invoice isn't just a request for payment; it's a formal piece of project documentation that integrates into the GC's overall financial reporting and payment schedule with the project owner.

Strategic Breakdown

The core strategy for a subcontractor invoice is compliance and integration. Your goal is to make it as easy as possible for the general contractor to approve your invoice and include it in their master payment application. Any deviation from their required format or missing documentation can cause significant payment delays, as the GC cannot bill the client for your work until your paperwork is perfect.

This approach minimizes friction in the payment chain and positions you as a reliable, professional partner. GCs prefer subcontractors who understand these procedural requirements, which can lead to more consistent work.

Actionable Takeaways for Implementation

To implement subcontractor invoicing effectively, focus on precision, documentation, and communication:

- Request a Template: Before starting work, ask the general contractor for a sample invoice or a specific template they require. This proactive step eliminates guesswork and ensures you submit a compliant document from the very beginning.

- Clarify Payment Schedules: Understand the GC's payment cycle. Know the cut-off dates for invoice submissions to be included in the next payment application to the owner and schedule your billing accordingly.

- Maintain a Compliance Checklist: For each project, create a checklist of required documents, such as lien waivers, certified payroll, or proof of insurance. Ensure all necessary attachments are submitted with every invoice.

- Follow Up Systematically: If a payment is late, a structured follow-up is key. For more tips on this, explore these strategies for writing the perfect payment reminder email to maintain professionalism while ensuring prompt payment.

7. Change Order Invoice

A Change Order Invoice is a crucial document used to bill for work that falls outside the scope of the original contract. This type of invoice is essential for managing project alterations, ensuring contractors are compensated for additional labour and materials, and maintaining transparency with clients. It formalises any deviation from the initial agreement.

This format is indispensable for projects where unexpected issues or client-requested modifications arise. Examples include discovering hidden structural damage during a renovation, accommodating a client's request to upgrade materials mid-project, or addressing unforeseen code compliance changes mandated by an inspector. The Change Order Invoice protects your profitability by clearly documenting and justifying these additional costs.

Strategic Breakdown

The core strategy behind a Change Order Invoice is scope management and financial protection. It creates an official record of any changes to the project, preventing "scope creep" from eroding your profit margins. This formal process transforms potential disputes into structured, agreed-upon additions to the contract.

By requiring signed approval before work begins, you ensure the client is fully aware of and agrees to the cost implications of their requests or of unexpected site conditions. This process reinforces your role as a professional partner, managing the project responsibly and transparently.

Actionable Takeaways for Implementation

To implement change order invoicing effectively, prioritise documentation and immediate communication:

- Standardise Your Forms: Create a standardised Change Order Form that includes fields for a detailed description of the change, the reason for it, a breakdown of new costs (labour and materials), and the impact on the project timeline.

- Get Written Approval First: Never proceed with extra work based on a verbal agreement. Always secure a signed change order from the client before purchasing materials or dedicating labour to the new task.

- Document Conditions Visually: Use photos and videos to document the conditions necessitating the change order, such as hidden rot or outdated wiring. This provides undeniable proof and helps clients understand why the additional work is required.

- Communicate Immediately: As soon as a potential change is identified, notify the client. Discuss the issue, the proposed solution, and the associated costs right away to manage expectations and make collaborative decisions.