At its core, sending an invoice is simple: you create a document, list what you did, state what's owed, and email it off. But there's a real art to crafting an invoice that doesn't just ask for money, but actually gets you paid on time. That’s where the details make all the difference.

Crafting an Invoice That Gets You Paid

Before you even think about hitting 'send', you need an invoice that's professional, clear, and buttoned up from a legal standpoint. A solid invoice is more than a bill; it’s a final, professional handshake that prevents misunderstandings, heads off disputes, and cuts down on payment delays. Honestly, getting this part right is the single most important thing you can do for your cash flow.

It’s the difference between a hastily scrawled sticky note and a formal agreement. One invites questions and delays, while the other provides everything needed to close out the project smoothly for both you and your client.

Building Your Invoice: The Must-Have Components

Every invoice you send should be a crystal-clear record of the transaction. When you include all the necessary details upfront, you eliminate the frustrating back-and-forth that so often holds up your money.

To start, let's put together a quick-reference table of the absolute essentials. These are the non-negotiables every professional invoice needs.

Key Components for a Professional Invoice

table block not supported

Having these elements in place makes your invoice easy to understand and process, which is exactly what you want.

Don't Be Vague: Describe Your Services Clearly

This is where I see so many freelancers and small businesses go wrong. A line item that just says "Consulting Services" for $2,000 is a red flag for any accounts payable department. It’s vague and immediately makes the client question the charge.

You need to break it down. Instead of a generic "SEO Work," an invoice for a digital marketer should look more like this:

- Keyword Research & Strategy (10 hours @ $75/hr)

- On-Page Optimization for 5 Core Web Pages (5 hours @ $75/hr)

- Monthly Performance Report & Analysis

Choosing Your Invoicing Tools

The tools you use to bill clients can say a lot about your business. When you're just starting out, a simple spreadsheet or a Word template can get the job done. For a freelancer with only a handful of projects each month, this manual approach often makes the most sense because it gives you total control with zero upfront cost.

But as your business picks up steam, you'll start to see the cracks in that manual system. Juggling invoice numbers, chasing due dates, and manually marking payments becomes a real headache. It's not just tedious; it's a recipe for costly mistakes. This is the moment when dedicated invoicing software stops being a "nice-to-have" and becomes essential for keeping things running smoothly.

When to Upgrade to Invoicing Software

Making the leap to proper invoicing software can feel like a revelation. These platforms are built to handle all the repetitive tasks that eat up your day, letting you focus on the work that actually makes you money. Automation isn't just about saving time—it’s about strengthening your financial health by making sure bills go out on schedule and follow-ups happen without you having to think about it.

So, how do you know it's time to switch? You're likely ready if you're dealing with:

- Time-Consuming Creation: It takes you more than a few minutes to put together and send a single invoice.

- Tracking Difficulties: You're constantly guessing which invoices are paid, pending, or overdue.

- Inconsistent Branding: Your invoices look slightly different each time, missing that polished, professional touch.

Modern tools come packed with features that can make a huge difference, like setting up recurring invoices for retainer clients, integrating with payment gateways so clients can pay online instantly, and sending out automated reminders for late payments. It's no wonder the global invoice processing software market is projected to hit USD 49.0 billion by 2031—it’s a clear sign of how much businesses, including many here in Canada, are leaning on automation.

Many of these invoicing tools can also talk to your other business systems. For example, connecting your invoicing platform to your customer relationship management (CRM) software creates a beautifully seamless workflow, from the first contact with a lead all the way to the final payment. You can learn more in our guide to CRM for small business growth. This kind of integration gives you a complete picture of every client relationship and financial history, all in one spot.

Sending Your Invoice Professionally via Email

Email is still the go-to for sending invoices for most of us. But how you send that email can make a huge difference. Just attaching a PDF and hitting 'send' is a missed opportunity. A thoughtfully written email doesn't just deliver the invoice; it reinforces your professionalism and makes it incredibly easy for your client to pay you.

Think of the email as a mini cover letter for your invoice. It should be friendly but direct, giving your client the key details—like the invoice number, total amount, and due date—right in the body of the email. This simple step saves them the hassle of having to open the attachment just to see what they owe. You're making their life easier, which is always a good thing.

Crafting the Perfect Invoice Email

Let’s start with the subject line. This is your first impression and, more importantly, a search tool for your client's accounts payable team. A generic subject like "Invoice" will get lost in a crowded inbox.

A specific, clear subject line is non-negotiable. I've found that a format including your company name and the invoice number works best. For example, "Invoice #INV-0042 from LeadFlow Manager" is immediately clear and easy to file or search for later. This one small tweak can genuinely speed up how quickly your invoice gets processed.

I've seen firsthand how a vague subject line can delay payments. Here’s a quick comparison to show you what I mean.

Upgrading Your Invoice Email Subject Lines

table block not supported

As you can see, the effective subject lines provide all the essential information before the email is even opened. It’s a small detail that communicates professionalism and helps the right person process your payment without delay.

Once you have their attention, the body of the email should be just as clear. I always recommend including:

- A polite, personalized greeting.

- A quick line confirming the invoice is attached for your recent work.

- The total amount and due date stated plainly in the text.

- A simple thank you and your contact details.

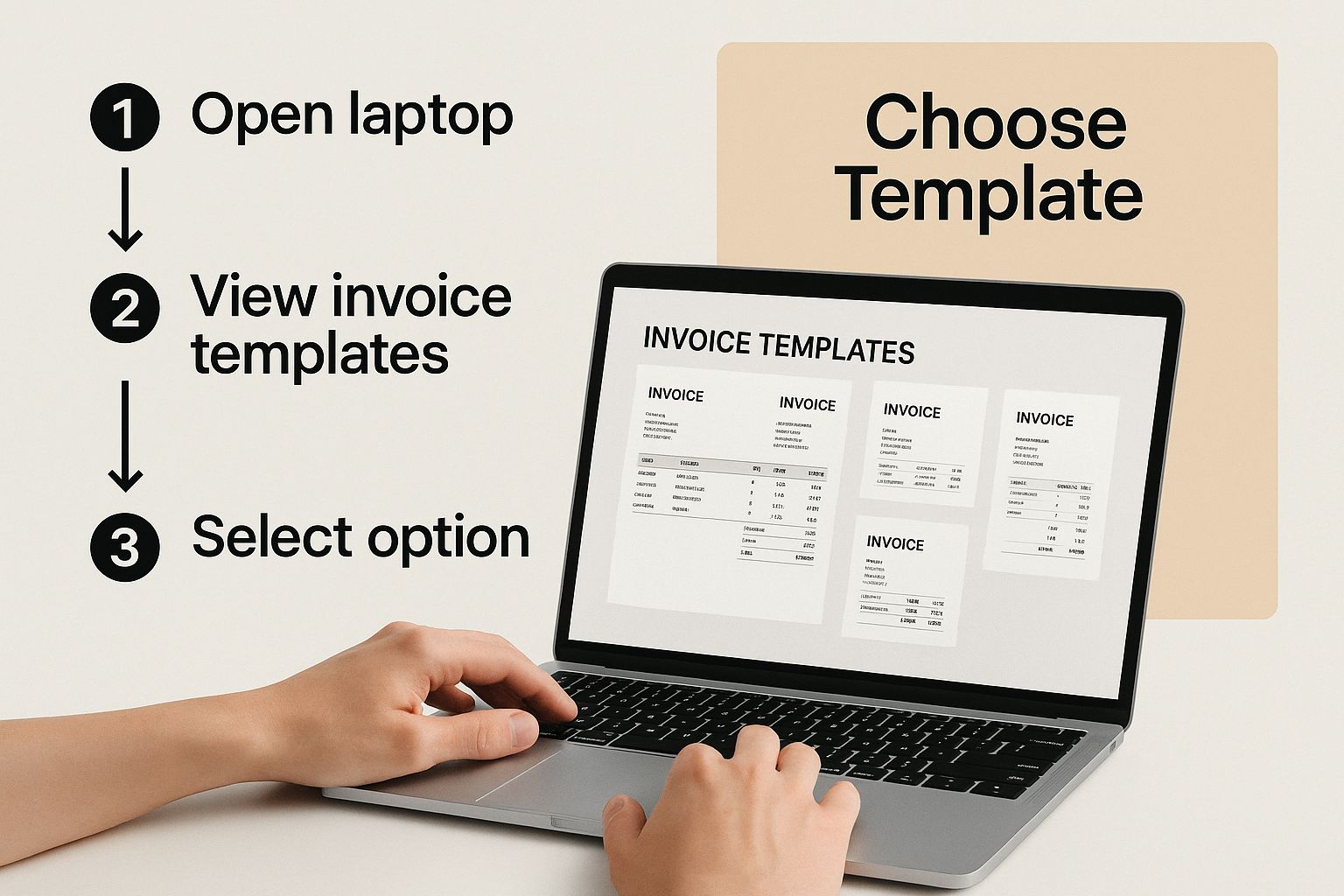

This visual guide breaks down the flow nicely, from picking a template to hitting send.

Seeing the steps laid out like this really drives home how a structured process leads to a much more professional and effective result.

One last, crucial tip: always attach your invoice as a PDF file. It's a professional standard for a reason. PDFs are universally accessible, look the same on any device, and lock the document to prevent any accidental changes. For more great tips on making sure your essential emails get the attention they deserve, it's worth reading up on transactional email best practices.

Many of these principles apply to other business communications too. For more on this, take a look at our guide on https://leadflowmanager.com/blog/crafting-the-perfect-confirmation-appointment-email.

Modern Ways to Deliver Your Invoice

Sure, email is the old standby for sending invoices, and it still works. But if that's the only tool in your toolbox, you could be leaving money on the table—or at least waiting longer for it. Let's look at a few modern delivery methods that can seriously upgrade your professional look and, more importantly, get you paid faster.

Many accounting software platforms now come with secure client portals, and frankly, they’re a game-changer. Instead of your client having to dig through a cluttered inbox, they can just log into a dedicated portal that’s branded with your logo. Everything is right there: past invoices, current bills, and a clear payment button. It’s cleaner for them and gives you a trail of when they’ve actually viewed the invoice.

Embracing E-Invoicing Networks

Taking it a step further, especially in the B2B and government worlds, is the move toward structured e-invoicing networks. In Canada, you’ll often hear about the Peppol network. This isn't just about emailing a PDF. It’s a completely standardized system where the invoice data zips directly from your accounting software right into your client’s. This completely wipes out manual data entry and the typos that come with it.

The momentum behind these systems is undeniable. The Canadian e-invoicing market was valued at around USD 319.73 million and is expected to jump to nearly USD 1,300 million by 2033. Businesses are quickly catching on to how much more efficient these tools are.

Using Text for Instant Notifications

Don't overlook the power of a simple text message. While you wouldn't send the entire invoice details via SMS, it's an incredibly effective way to give your client a nudge. A quick, automated text can let them know an invoice just hit their email or is waiting for them in their portal. This simple touch can dramatically cut down payment times.

If you want to add this to your workflow, learning how to send automated text messages can make the whole process effortless.

Mastering the Payment Follow-Up

Sending the invoice is often just the first step. The real test of your process begins when the due date passes. Having a proactive, professional follow-up strategy is non-negotiable for keeping your cash flow healthy and your client relationships intact.

This isn't about hounding people for money. It's about clear communication and making it simple for them to pay you. Many of us feel awkward chasing down payments, but having a system completely removes that anxiety. A simple, automated reminder a few days before the due date can be a lifesaver for a busy client. It changes the tone from "Where's my money?" to "Hey, just a friendly heads-up about this."

Crafting a Reminder Timeline That Works

Once an invoice is officially overdue, your approach can become more direct, but it must always stay professional. Having a clear timeline helps you handle this consistently every single time.

Here’s a practical approach I’ve seen work wonders:

- 1-3 Days Overdue: Start with a polite email. Your first assumption should always be positive—they might have simply missed the original invoice or payment could be processing.

- 7-14 Days Overdue: Time for a slightly more direct email and a quick phone call. Re-attach the invoice and ask if they have everything they need from your end.

- 30+ Days Overdue: At this point, your communication needs to be firm. Clearly outline the next steps you'll be forced to take if payment isn't received soon.

In Canada, prompt payment cycles are vital for business health, especially when you consider the country's economic landscape. For instance, a recent month saw a goods trade deficit of $5.9 billion. Efficient invoicing helps businesses navigate these conditions. You can find more on the latest Canadian international trade data on StatCan.

If you need a hand with the specific wording, our guide on writing the perfect payment reminder email has templates you can use right away.

A Few Common Questions About Sending Invoices

Even with a rock-solid invoicing process, some questions always seem to pop up. Let's walk through a few common ones I hear all the time, because getting the answers right can make a huge difference to your cash flow.

Does the time of day I send an invoice really matter? Surprisingly, yes. I've found that sending an invoice first thing on a Tuesday morning gets a much better response rate than, say, a Friday at 4:30 PM. The last thing you want is your invoice getting buried in a weekend pile-up.

Another classic: how long should I wait before sending a payment reminder? There’s no single magic number here. My go-to strategy is to send a friendly, gentle nudge about three to five days after the due date has passed. Always assume the best—it's often just an honest mistake or an oversight.

What About Charging Late Fees in Canada?

This is a big one for Canadian businesses. The short answer is yes, you can absolutely charge late fees on overdue invoices. However, there's a catch: you can't just decide to add them after an invoice is already late.

Your policy on late fees must be clearly stated in your original contract or service agreement. It's a non-negotiable part of setting up the business relationship from day one.

To do this properly and keep everything above board, make sure your contract includes a clause that spells out:

- The specific interest rate you’ll charge on overdue payments.

- The exact date from which that interest will begin to build.

This proactive communication sets clear expectations and protects your business. Making sure your payment terms are understood and signed off on before any work starts gives you a solid foundation and ensures everyone knows their financial responsibilities.

Ready to ditch the spreadsheets and finally get your sales process organized? LeadFlow Manager gives you the tools to track leads, manage your team, and get paid faster. Discover how LeadFlow Manager can help your business today.