Ready to start accepting credit cards? It's a big step, but it's simpler than you might think. You'll need to team up with a payment processor, get the right hardware or software sorted, and make sure your whole setup is secure. Think of providers like Square or Moneris, and you're on the right track.

Your Starting Point for Accepting Payments

Jumping into the world of credit card payments is a game-changer for any Canadian business. Let's be honest, it's not a "nice-to-have" anymore; customers expect it. With credit card use skyrocketing over the past 20 years, not accepting them means you're likely leaving money on the table.

But where do you even start? The whole system can feel a bit overwhelming, with terms like "merchant accounts" and "payment gateways" thrown around. Let's cut through the noise and break it down.

The Core Components You Need to Understand

At its heart, the process has a few key pieces that work together every time a customer pays.

First up is the merchant account. This isn't your regular business bank account. It's a special account designed specifically to hold funds from credit and debit card sales before they're transferred over to your main account.

Then you have the payment processor. This is the company that does the heavy lifting, acting as the middleman between your customer's bank and your bank. They're the ones who check for sufficient funds, get the transaction approved, and make sure the money gets to you. In Canada, big names like Square, Stripe, and Moneris fill this role.

Finally, there’s the payment gateway. This is the technology that securely grabs the customer's card details and passes them along to the processor. If you're running an online store, this is your checkout page. For a brick-and-mortar shop, your POS terminal or card reader is the gateway.

Deciding How You Will Take Payments

How you'll accept payments really comes down to how you do business. The way you interact with your customers will point you to the right setup.

Most businesses fall into one of three buckets:

- In-Person Payments: This is for you if you run a retail store, a restaurant, or any business with a physical storefront. You'll be looking at a point-of-sale (POS) system or a classic countertop card terminal.

- Online Payments: A must for any e-commerce site or if you send invoices to clients online. This means you'll need to integrate a payment gateway right into your website or invoicing software.

- Mobile Payments: Perfect if your business is on the go. Think food trucks, market stalls, or mobile service technicians. The solution here is usually a small card reader that connects to a smartphone or tablet.

Nailing these basics is the first real step. Your choice of processor and hardware will flow directly from which of these scenarios fits your business. Getting it right from the start lays the foundation for a payment system that’s smooth, secure, and helps you grow.

Choosing the Right Payment Processing Partner

Picking a payment processor is one of those decisions that feels small but has a huge impact on your business. It's not just about a piece of tech; it's about your cash flow, your customer's experience, and ultimately, your bottom line. A good partner just works, humming along in the background. A bad one? Well, that's a fast track to headaches from hidden fees, terrible support, and tech that just won’t cooperate.

For businesses here in Canada, the options are pretty varied. You've got the old guard like Moneris, the big global players like Stripe, and the do-it-all solutions like Square. Your job is to cut through the marketing fluff and find the one that actually fits your sales volume, your business model, and how comfortable you are with the tech side of things.

Decoding the Pricing Models

First things first, let's talk about how these companies charge you. Getting a handle on their fee structures is the most important step. Most processors use one of three main models, and each has its own sweet spot.

- Flat-Rate Pricing: This is as straightforward as it gets. You pay a simple, predictable percentage plus a tiny fixed fee on every single transaction (think 2.65% + $0.10). It’s the model that companies like Square and Stripe made famous. This is perfect for new businesses or those with lower sales volumes because you always know exactly what you’re paying. No surprises.

- Interchange-Plus Pricing: Often called cost-plus, this is by far the most transparent option. You pay the direct interchange fee set by the card networks (like Visa and Mastercard) and a small, fixed markup that goes to the processor. For businesses with higher sales, this is usually the cheapest route because the processor's profit margin is laid bare.

- Tiered Pricing: This model lumps various interchange rates into different buckets, usually called something like "qualified," "mid-qualified," and "non-qualified." It looks simple on paper, but it's often the most expensive and opaque because the processor gets to decide which transactions get downgraded into the pricier tiers.

Comparing Top Payment Processors for Canadian Businesses

To make this a bit more concrete, I've put together a quick comparison of some popular choices for small to medium-sized businesses in Canada. This isn't an exhaustive list, but it gives you a good starting point for seeing how the different models play out in the real world.

table block not supported

This table highlights the trade-offs you'll be making. While flat-rate is simple, interchange-plus providers like Helcim can offer significant savings as you scale, without locking you into a long-term contract.

Key Factors for Your Evaluation

Transaction fees are just one piece of the puzzle. A super-low rate can look tempting, but it might be hiding hefty monthly account fees or a nightmare of a contract.

Pay close attention to the contract terms. Some processors will try to lock you into multi-year deals with massive early termination fees. I always recommend looking for providers who offer month-to-month, pay-as-you-go service. It gives you the flexibility a growing business needs.

Another thing people often forget until it's too late is customer support. Because trust me, something will eventually go wrong, and when it does, you need to be able to get a real, helpful human on the line. Before you sign anything, check for phone support, see if they have live chat, and read online reviews specifically about their service quality. A processor that's a ghost when you're in a crisis is not a real partner.

Integration and Technical Capabilities

Your payment processor needs to play nice with the other tools you use to run your business. If you're on Shopify, you need a processor that integrates seamlessly. If your whole sales process lives in a CRM, a direct connection can be a game-changer, automating data entry and saving you hours of tedious work.

For those who want to build something more custom, digging into the processor's API documentation is a must. To get a sense of what's possible, you can check out examples of API documentation for sales tools to see how different systems are designed to talk to each other.

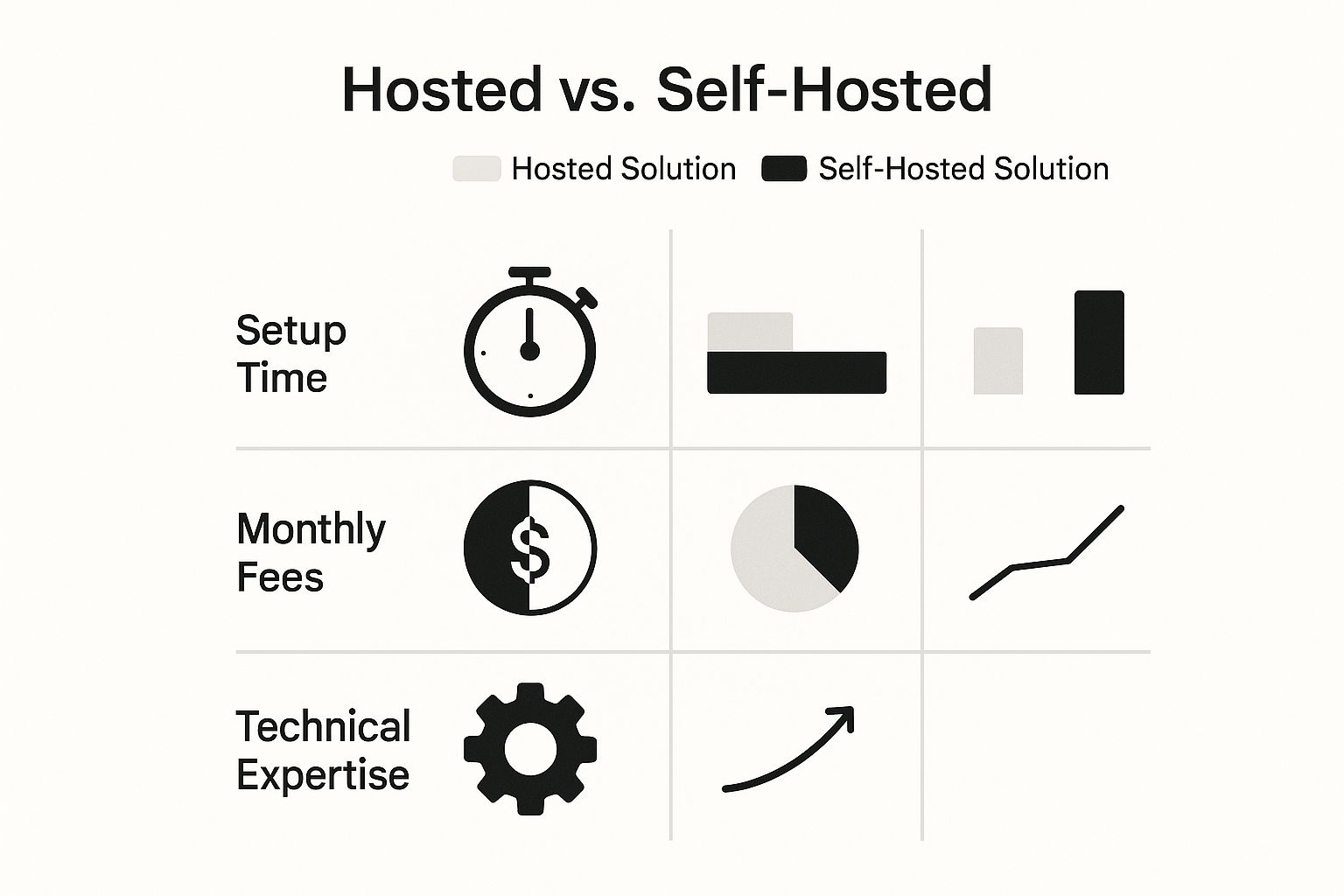

The image below breaks down the difference between a simple, hosted solution (like a standard Shopify checkout) and a self-hosted gateway that gives you more control but also requires more technical know-how.

As you can see, there's a clear trade-off. Hosted solutions get you up and running fast, but the convenience can come with higher fees. Self-hosted options require more work upfront but can lead to lower costs in the long run.

Ultimately, your goal is to make paying you as easy as possible for your customers. The data on this is overwhelming. In the U.S., credit card use shot up from just 18% of all payments in 2016 to 35% in 2024. This change is being driven by things like tap-to-pay, which can cut checkout times by up to 60%. A faster, smoother checkout means a happier customer and a completed sale. Your choice of processor is what makes that experience possible.

Getting Your Payment Hardware and Software Up and Running

You’ve picked your payment processor, so now it's time for the fun part: getting everything set up. This is where those abstract decisions about fees and features become a real, working part of your business. Whether you’re opening a busy retail shop or launching an online store, your hardware and software are what will actually connect you to your customers’ wallets.

The great news? Modern systems are designed to be incredibly user-friendly. Forget the days of clunky, confusing setups that needed an IT pro on standby. Today, you can often get everything up and running in less than an hour.

For Brick-and-Mortar Businesses

If you're dealing with customers in person, your point-of-sale (POS) terminal is your new best friend. For most new businesses, this journey begins by unboxing a sleek device like a Square Reader or a Clover Flex. The whole process is usually a breeze.

You'll start by powering on the device and connecting it to your secure Wi-Fi. From there, it will walk you through logging into your processor account. This is the crucial step that links the physical machine to your merchant account, telling the money exactly where it needs to go.

Before you even think about your first real customer, you absolutely must run a test transaction. Seriously, don't skip this. Ring up a tiny amount, say $1.00, and pay with your own credit card. This simple action confirms three vital things:

- Connectivity: Your terminal is actually talking to your processor.

- Payment Flow: The transaction goes through correctly without any hiccups.

- Deposits: The money lands in your business bank account in the expected 1-2 business days.

Taking five minutes to do this can save you from a world of headaches and awkward conversations with customers later on.

Choosing Your In-Person Hardware

For in-person sales, you're generally looking at two paths for your hardware, and each has its own strengths.

- Traditional Terminals: These are the workhorses you see on countertops everywhere. They're built for one job—taking payments—and they do it reliably. If you’re expecting high volume, their durability is a huge plus.

- Tablet-Based Systems: Picture an iPad connected to a small card reader. Systems from companies like Square have really changed the game here. They don't just process payments; they can manage your inventory, track customer info, and pull sales reports, turning a simple tablet into a powerful business hub.

For E-commerce and Online Businesses

When you're selling online, your "hardware" is actually a piece of software called a payment gateway. Think of it as the digital bouncer that securely connects your website’s checkout page to your payment processor. Setting it up is less about plugging in cables and more about a simple digital handshake.

Most e-commerce platforms like Shopify or WooCommerce make this incredibly straightforward. They have pre-built integrations for major processors like Stripe. You literally just pick your processor from a dropdown menu, pop in your account details (usually called API keys), and you're done. It's a no-code process that can have you accepting credit cards securely in minutes.

Mobile Solutions for Sales on the Go

But what if your business is always on the move? For food trucks, market vendors, or plumbers making house calls, a mobile POS isn't just a nice-to-have; it's essential. This setup is usually just a small, pocket-sized card reader that connects to an app on your smartphone via Bluetooth.

Suddenly, the phone you already own is a full-blown payment terminal. You can take chip, tap, and swipe payments wherever you have a cell signal. This kind of flexibility opens up entirely new ways to make money and ensures you never have to turn away a sale because a customer doesn't have cash. As tap-to-pay becomes second nature for even small purchases under $25, offering these payment methods is crucial. You can find more data on these transaction trends and what they mean for businesses over at coinlaw.io.

Navigating Security and PCI Compliance

https://www.youtube.com/embed/jcJpVEv16pk

The moment you decide to accept credit cards, you’re also signing up to protect your customers' financial information. This isn't just a box to tick on a checklist; it's the bedrock of the trust that keeps your customers loyal. Stepping into the world of data security can feel overwhelming, but getting a handle on the basics is crucial for protecting your business and your clients.

The main set of rules you need to get familiar with is the Payment Card Industry Data Security Standard, or PCI DSS for short. Think of it as the official playbook for handling credit card information safely. It was put together by the big names like Visa and Mastercard to clamp down on card fraud. Following these guidelines isn't just a good idea—it's mandatory for any business that processes, stores, or even just passes along cardholder data.

Making Sense of PCI Compliance for Your Business

For most small business owners, the good news is that PCI compliance doesn't have to be a complicated mess. Modern payment processors do most of the heavy lifting, but that doesn't let you completely off the hook. How much you have to do really depends on how you take payments.

The guiding principle here is to reduce your scope. In simple terms, this just means minimizing your contact with sensitive card data as much as humanly possible. Here’s what that looks like day-to-day:

- Don't Store Cardholder Data. Ever. This is the number one rule. Never, ever write down, save in a spreadsheet, or store a customer's full credit card number, expiry date, or CVV code. A breach involving stored card details can be financially crippling, thanks to hefty fines and the instant loss of customer trust.

- Use Compliant Gear. When you use a PCI-compliant terminal from a trusted processor like Square or Moneris, the device encrypts the card data the second it's tapped or swiped. This process is called end-to-end encryption (E2EE), and it scrambles the sensitive info before it even has a chance to touch your network, which dramatically lowers your risk.

- Lock Down Your Network. Always use a secure, password-protected Wi-Fi network for your payment devices. Processing transactions over a public or unsecured Wi-Fi network is asking for trouble.

The Yearly Self-Assessment Questionnaire (SAQ)

To show that you're playing by the rules, you'll most likely need to fill out a Self-Assessment Questionnaire (SAQ) every year. It’s essentially a checklist that helps you confirm your payment setup is secure.

The specific SAQ you'll need depends entirely on your setup. For example, a business using a single, encrypted payment terminal will have a much shorter and simpler form to deal with than an e-commerce site with a custom-built online checkout. Your payment processor will usually walk you through this, often giving you an online portal to make it easier. It might feel like a bit of a chore, but think of it as a critical annual health check for your business's security.

What a Data Breach Actually Looks Like

Let's be clear: ignoring PCI compliance can have devastating consequences. A data breach isn't just a technical headache; it can trigger a cascade of problems:

- Serious Fines: The card brands can impose penalties that run from thousands to tens of thousands of dollars per month until you get back into compliance.

- Eroded Trust: News of a breach travels fast. Customers are rightfully nervous about businesses that can't keep their data safe, and that damage to your reputation can be permanent.

- Legal Headaches: You could easily find yourself facing lawsuits from customers whose information was compromised.

Protecting customer data isn't just a compliance task—it's a fundamental part of running a healthy business. For a deeper dive into these principles, you can review our guide on data privacy and security policies. By being proactive about security, you’re not just protecting data; you’re building a stronger, more trustworthy business.

Optimizing Your Checkout to Boost Sales

Just being able to take credit cards is table stakes. The real magic happens when you transform that simple capability into a seamless experience that actually drives sales and protects your hard-earned revenue.

This isn't just about the transaction itself. It’s about looking at the entire customer journey, from the moment they decide to buy right through to the final "thank you" page. It also means doing a bit of financial housekeeping to make sure you aren't bleeding profits from hidden fees or preventable chargebacks.

Reducing Friction at Checkout

Friction is the ultimate sales killer. Every little obstacle, delay, or moment of confusion during checkout is an opportunity for a motivated buyer to walk away. Your goal should be to make paying you the easiest thing they do all day.

This is especially true for online stores, where a clunky checkout form is a notorious conversion-wrecker. You have to ask yourself: are you only collecting the absolute essential information needed to process the order?

- Embrace Digital Wallets: Get options like Apple Pay and Google Pay integrated. They let customers fly through checkout with a single tap, using information that’s already saved to their device. It's a game-changer.

- Simplify Your Forms: Take a hard look at every field in your checkout. Is it truly necessary? Ditch the optional ones and use tools like address auto-complete to cut down on typing.

- Show the Finish Line: If your checkout has multiple steps, use a progress bar. It lets customers know exactly where they are in the process and how close they are to being done, which really helps reduce abandonment.

The same thinking applies in a physical shop. Nobody likes waiting in a long queue. Having contactless (tap-to-pay) isn't just a nice-to-have anymore; it's a must. It makes every transaction faster, which keeps customers happy and lets you serve more people during your busiest hours.

Decoding Your Merchant Statements and Managing Costs

Once payments start rolling in, you need to have a firm grasp on where every dollar is going. Your monthly merchant statement holds all the answers, but let's be honest, they can be incredibly confusing. Learning to read it is a critical skill for keeping your costs in check.

Look for a detailed breakdown of all the fees. You should be able to clearly see the interchange rates, your processor's markup, and any other monthly or one-off charges. If your statement is just one big, confusing number, it's time to demand more transparency from your provider. I've seen business owners save a surprising amount of money just by spotting and questioning odd fees.

To cast a wider net and bump up your average sale, you could also think about offering flexible payment plans. This strategy breaks a big purchase into smaller, more manageable payments, making your products or services accessible to a whole new group of customers.