Why Customer Acquisition Cost Actually Matters Beyond The Numbers

Let's be real, "customer acquisition cost calculation" sounds about as exciting as watching paint dry. Spreadsheets and formulas? Not exactly a party. But after working with tons of sales teams, I've seen firsthand how messing up your CAC can lead to some truly disastrous decisions. It's not just a number, it's a vital sign for your business's growth.

Think of your CAC as a health check. A healthy CAC? Your growth engine is purring. A high CAC? Warning lights should be flashing. It could point to all sorts of problems, like throwing marketing dollars down the drain or targeting the wrong customers. Understanding your CAC is like having a diagnostic tool for your entire sales and marketing operation.

Hidden Costs and the Real CAC

CAC calculations can uncover hidden costs quietly eating away at your budget. Are you factoring in onboarding time? What about the cost of acquisition-specific software? These often-forgotten expenses can seriously inflate your true CAC. Knowing where these hidden costs lurk is the first step to optimizing them.

The Caribbean Context: Unique CAC Challenges

In regions like the Caribbean, nailing down your CAC can be especially tricky. Limited digital infrastructure and slower adoption of analytics tools mean many businesses struggle to get accurate data. This makes careful tracking and analysis even more vital for sustainable growth. For example, in the Caribbean food and beverage industry, the average CAC in similar B2C markets is around 53 per new customer**. However, some businesses shell out between **300 and $500 per acquisition because of inefficiencies or fierce competition. Discover more insights

Don't Just Memorize the Formula, Change Your Mindset

Ignoring the nuances of CAC can lead you down the wrong path. I've seen companies dump cash into flashy campaigns that look amazing on paper but deliver a sky-high CAC, leaving them with few new customers and an empty wallet. This isn't about memorizing formulas, it's about fundamentally shifting how you think about every single marketing dollar. Ready to dive deeper into the real power of CAC?

Let's take a look at typical CAC benchmarks across various industries to get a better sense of where your business should be aiming.

CAC Benchmarks by Industry Sector Description: Comparison of average customer acquisition costs across different business sectors with efficiency indicators

table block not supported

As you can see, there's a significant range in CAC depending on the industry. Understanding these benchmarks and the related pain points can help you contextualize your own CAC and identify areas for improvement within your specific market.

The Real Customer Acquisition Cost (CAC) Calculation Formula

The basic formula for Customer Acquisition Cost (CAC) looks pretty simple: CAC = (Cost of Sales + Cost of Marketing) / Number of New Customers. But just like baking a cake, the final result depends on the ingredients. And believe me, I’ve seen some interesting ingredient lists when it comes to calculating CAC.

This Wikipedia screenshot gives you a basic idea of CAC – how marketing spend, sales costs, and new customer numbers relate. It’s helpful for the core components, but it doesn't show the real-world picture. It's like saying a cake is just flour, sugar, and eggs – you're missing key elements!

While the graphic is a decent starting point, it glosses over things like overhead and internal team time. For example, if your marketing team spent a week developing a campaign, their salaries are part of your “Cost of Marketing," even if it’s not a direct ad buy. The same applies to sales team salaries, commissions, and bonuses tied to landing new clients.

Beyond The Obvious Expenses: Finding Hidden Costs

Don't just think about ad spend and sales commissions. What about onboarding costs for new customers? Or the cost of software subscriptions your sales and marketing teams use, like your CRM or email marketing platform? These hidden costs can significantly impact your true CAC, potentially giving you a distorted view of how efficiently you're acquiring customers.

Shared Expenses: Solving The Attribution Puzzle

Allocating shared marketing expenses is another challenge. Let's say you have a social media campaign designed to both acquire new customers and retain existing ones. How do you split the cost? One common way is to assign a percentage based on the campaign’s main objective. If acquisition was the primary goal, attribute a larger chunk of the cost to your CAC calculation. This can get complicated, especially with multi-channel campaigns, but it's vital for getting an accurate CAC.

Timing Is Everything: Keeping Your Calculations Consistent

The timeframe you choose for your calculations is also important. Are you calculating monthly, quarterly, or annual CAC? This really depends on your specific business model and sales cycle. For longer sales cycles, a quarterly or annual calculation often makes more sense, smoothing out short-term ups and downs. Consistency is key here. Using the same timeframe lets you track trends and compare apples to apples. Choosing the wrong timeframe can mask problems or create unnecessary stress.

Collecting CAC Data Without Going Completely Insane

Calculating your customer acquisition cost (CAC) accurately depends on having good data. But getting your hands on that data can sometimes feel like a nightmare. I've been there, buried under spreadsheets and mismatched reports. It can be truly frustrating. But don't worry! The best sales managers aren't drowning in data; they're strategically targeting the data that actually makes a difference.

From Chaos to Clarity: Organizing Your Metrics

The trick is building a system that works with you. Think of your CRM (Salesforce, HubSpot, whatever you use) as your command center. If it isn't set up to track the right metrics for CAC analysis, you're already playing catch-up. Begin by identifying your most important data points. This might include marketing campaign costs, sales team salaries, and of course, the number of new customers you're bringing in.

Also, think about your digital marketing strategy. A good rule of thumb is to allocate 45-55% of your marketing budget to digital channels. This can lead to big improvements in your CAC. I've seen firsthand how businesses, even in niche markets like the Caribbean, saw significantly better customer acquisition through social media and email after boosting their digital spend within this range. Discover more insights. Don’t feel pressured to collect every single piece of data. Start with the essentials and add more complex metrics as your tracking gets more sophisticated.

Taming the Multi-Channel Beast: Attribution Solutions

One of the biggest challenges with CAC is attribution. What happens when a customer interacts with multiple channels before finally buying? Which channel gets the credit? There isn't one right answer, but there are practical ways to approach it. One common method is assigning weighted values to different touchpoints.

For example, imagine a customer first clicks a social media ad, then attends a webinar, and finally converts through a sales call. You might give the most weight to that final sales call. After all, that's what closed the deal. You can adjust those weights based on what you see happening in your own sales cycle. You might also be interested in: Getting Started With LeadFlow Manager

Embracing Imperfect Data: Progress Over Perfection

Here’s a little secret: nobody has perfect data. Don’t let the pursuit of flawless metrics stop you from getting started. Work with what you've got, even if it’s a bit messy. Focus on improving your tracking bit by bit.

Maybe this week, you add a new field to your CRM to track lead source. Next month, you integrate your marketing automation platform (Marketo, Pardot, etc.) to track campaign costs. Small, consistent steps like these will pay off big time in the long run. Remember, the goal isn't to eliminate every single imperfection. It’s to get a clear enough picture to make smart decisions about your customer acquisition cost. This gives you the flexibility to adapt as you refine your strategy. Focus on the data that makes the biggest impact first and build from there.

Customer Acquisition Cost Calculation In Action

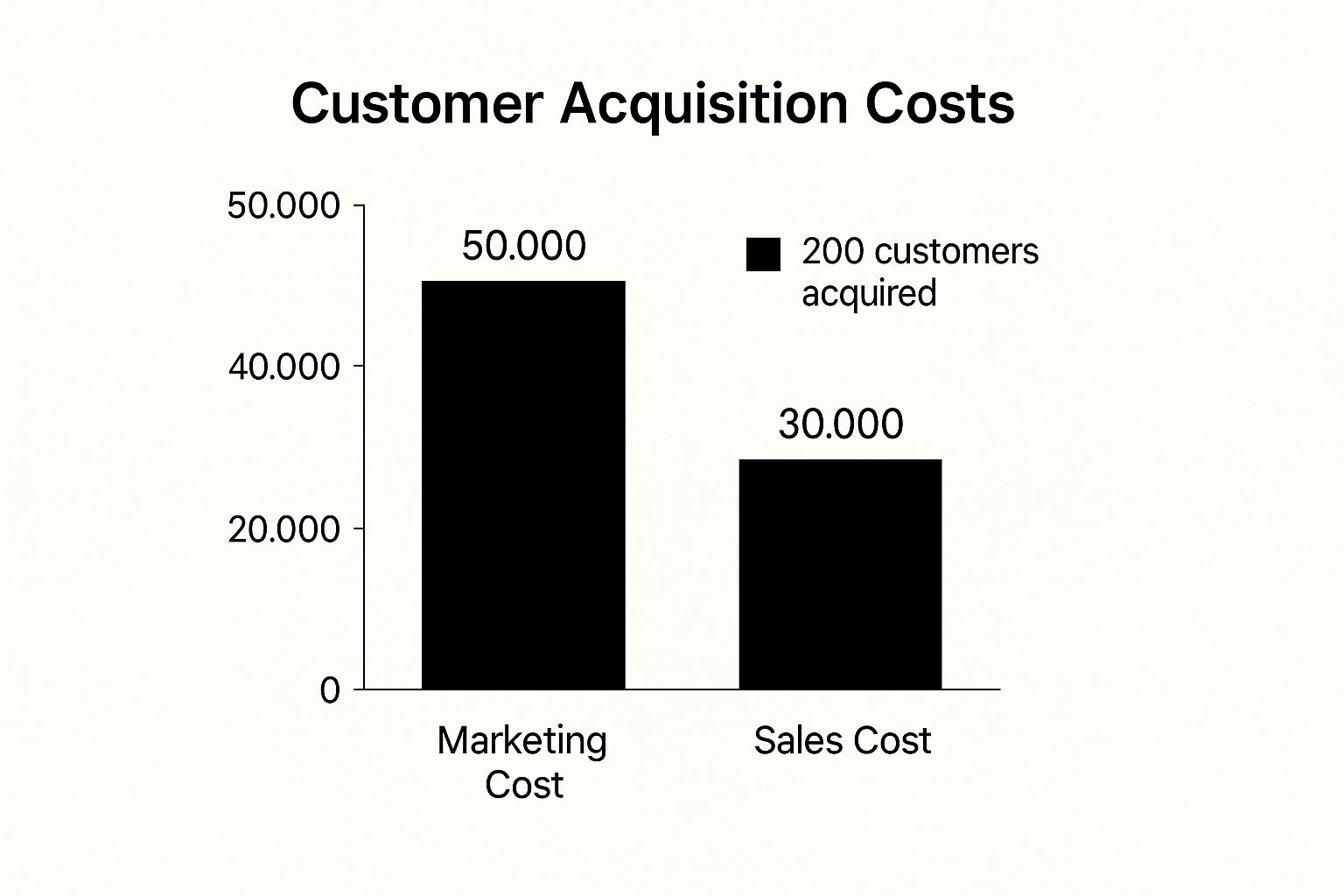

This infographic breaks down the marketing and sales costs that went into acquiring 200 new customers. Marketing chipped in 50,000**, while sales added another **30,000. Doing the math, that's roughly **400** to acquire each new customer ((50,000 + $30,000) / 200). This shows you the basic idea behind customer acquisition cost (CAC) calculation, but in the real world, things can get a bit more interesting.

Navigating Seasonal Spikes and Dips

Let's say you run a landscaping business in the Caribbean. Think about how your marketing spend ramps up during hurricane season prep. Homeowners are scrambling to get their properties ready, and you're right there with targeted Facebook ads. You might drop 10,000** on Facebook ads in May and June, snagging **100 new clients**. That's a **100 CAC – not bad. But then November rolls around, things quiet down, and you only get 20 clients for your 2,000** spend. Suddenly, your CAC is back up to **100. This is why seasoned sales managers look at CAC over a longer period, like a year, to smooth out those seasonal bumps and get a more realistic view.

The Long Game: B2B Sales Cycles

Now, switch gears and imagine a B2B software company like LeadFlow Manager. Selling a CRM platform is a marathon, not a sprint. You've got demos, follow-up emails, multiple sales calls – all adding to the cost. Figuring out how much each customer really cost gets tricky. The solution? Track your sales and marketing expenses tied to specific leads throughout the entire sales cycle. This gives you a much clearer CAC calculation that reflects the true investment in each client.

Multi-Channel Attribution: Untangling the Web

Most businesses aren't just relying on one marketing tactic. It's a mix of social media, email campaigns, local events, maybe even some word-of-mouth referrals. The question becomes: who gets the credit for a new customer? Imagine someone hears about you at a community event, then clicks a Google ad to check out your website, and finally signs up after getting a follow-up email. Which touchpoint was the clincher? One common way to handle this is to give each interaction a weighted value based on how much it influenced the customer's decision. This helps you see which channels give you the best bang for your buck.

Segmenting for Deeper Insights

Breaking down your CAC by customer segment can unlock some serious insights. You might discover that online channels are way cheaper than traditional advertising. That kind of knowledge helps you fine-tune your marketing spend and target specific channels for better results. This not only lowers your overall CAC, but lets you tailor your marketing to resonate with different customer groups.

Let's look at some examples of how CAC calculations play out across different business models:

The following table provides step-by-step examples for various business types and sales cycles.

CAC Calculation Scenarios by Business Model

table block not supported

As you can see, the approach to calculating CAC, and the resulting cost itself, varies significantly depending on the nature of the business. Understanding these nuances is crucial for making informed decisions about your marketing and sales strategies.

Decoding What Your CAC Numbers Really Mean

So you've calculated your customer acquisition cost (CAC). Great! But that's just the starting point. Knowing the number is one thing, understanding what it means for your business is where the real value lies. Think of it like this: experienced sales managers don’t just look at the raw data; they analyze the story it's telling. Let's dive into how to interpret your CAC and turn it into a powerful tool for making smart decisions.

Healthy CAC vs. Cause for Concern

What constitutes a "good" CAC? Honestly, it varies. A CAC of $1,000 could be a home run for a company selling enterprise software, but a complete disaster for a local bakery. Factors like your specific business model, industry benchmarks, and even your company's growth stage all come into play. Don't get caught up comparing yourself to generic averages. Instead, focus on the relationship between your CAC and your customer lifetime value (CLTV).

A healthy CAC lets you recoup your initial acquisition investment within a reasonable timeframe – ideally, within a year. The general rule is a 3:1 CLTV:CAC ratio. This means you're making three times more revenue from a customer than it cost to acquire them. A lower ratio could indicate underlying problems, while a significantly higher ratio might mean you're underspending on acquisition and leaving potential growth on the table.

Spotting Trends and Avoiding Expensive Problems

Pay close attention to how your CAC changes over time – that’s often more telling than the absolute number itself. A sudden spike could be a warning sign, pointing to increased competition or marketing campaigns that aren't hitting the mark. Conversely, a steady downward trend usually means your acquisition strategies are working. Regularly monitoring your CAC helps you spot these trends early and make adjustments before small issues become major, budget-busting headaches. For more on optimizing your lead flow, take a look at our guide on lead routing best practices.

External Factors: Reading Beyond the Numbers

Sometimes, things outside your control can influence your CAC calculations. Consider seasonal fluctuations: a landscaping business in California might see a surge in demand (and higher CAC) after a major storm. Recognizing these external influences is crucial for accurately interpreting your data. Don't freak out over short-term spikes if they're tied to predictable seasonal trends or other external events.

The Big Picture: Key Performance Indicators

The best sales managers don’t just focus on CAC in isolation. They look at it alongside other key performance indicators (KPIs) like conversion rates, sales cycle length, and customer churn rate. These metrics give you a more holistic view of your acquisition performance, highlighting areas for improvement and informing decisions about where to allocate resources. Understanding how these metrics interact allows you to make data-driven choices that fuel sustainable growth.

Turning CAC Insights Into Better Acquisition Strategy

This is where customer acquisition cost (CAC) calculation gets real. It's less about the spreadsheet and more about turning those numbers into a strategy that works. Savvy sales managers don't just calculate CAC; they use it to decide where their marketing budget is best spent and which channels are actually delivering.

Refining Your Approach: Reducing CAC Without Sacrificing Quality

Lowering your CAC isn't about attracting a flood of low-quality leads. Think of it this way: attracting tons of leads who aren't a good fit might look impressive at first, but if they don't convert, it’s a waste of resources. It's like trying to fill a bucket with a hole in it. Instead, concentrate on getting the right customers – the ones who have the potential to become loyal, long-term clients. Understanding your ideal customer profile (ICP) and making sure your marketing efforts are laser-focused is key. You might be interested in: 10 Best Lead Management Software for Sales Teams in 2025

Discovering Your Goldmines: Identifying Cost-Effective Channels

Not all acquisition channels are equal. Some, like paid advertising, can be pricey, but they give you fast results. Others, like organic search (SEO), require patience but can be incredibly cost-effective over time. The trick is figuring out which channels are delivering your most valuable customers for the lowest cost. This usually means testing different channels and carefully monitoring your results. Don't be afraid to drop the channels that aren't working and put more effort into the ones that are.

The High CAC Paradox: When Spending More Makes Sense

There are times when a higher CAC isn't a bad thing. It might seem counterintuitive, but consider this: if you're bringing in high-value customers who will stick around, spending more upfront can be a really smart investment. It's all about looking at the big picture and factoring in customer lifetime value (CLTV). If your CLTV significantly exceeds your CAC, acquiring those high-value customers, even at a higher cost, can give you a real competitive edge.

Testing and Optimizing: The Continuous Improvement Cycle

Customer acquisition is a constant work in progress. It requires consistently trying new things, analyzing the results, and making changes as needed. This could involve tweaking your messaging, targeting different demographics, or exploring new channels. The important thing is to stay flexible and adapt as the marketing world changes. This helps you stay on top of your game and acquire customers at the lowest possible cost.

Balancing Short-Term Goals and Long-Term Vision

Managing CAC is all about finding the right balance. You need to keep both your short-term acquisition goals and your long-term growth plans in mind. Sometimes, investing more in acquisition early on pays off in the long run by netting those high-value customers. Other times, focusing on immediate cost reductions might be essential for hitting short-term targets. The key is to find the sweet spot that supports your overall business strategy, letting you grow sustainably while maximizing profits.

Common CAC Mistakes That Destroy Marketing Budgets

I've seen it happen time and time again: smart sales managers making costly mistakes with their Customer Acquisition Cost (CAC). It's not about being bad at math, it's usually about focusing on the wrong things or misinterpreting the data. Let me share some of the biggest CAC blunders I've seen firsthand, so you can avoid them.

Calculation Errors: The Devil's in the Details

One of the most common slip-ups? Forgetting the hidden costs. Think about those software subscriptions you're paying for, the hours your team spends on marketing activities, and even onboarding expenses. These all contribute to your CAC. Leaving them out paints a deceptively rosy picture and makes your CAC calculation way off. Another frequent mistake is comparing apples and oranges – like monthly CAC to annual CAC. Choose a timeframe (monthly, quarterly, or annually) and stick with it for accurate comparisons.

Short-Term Obsession: Missing the Big Picture

Another trap is getting obsessed with short-term CAC changes. If you're in a seasonal business (especially down in the Caribbean!), you're going to see natural peaks and valleys. A CAC spike during hurricane season in the CA region doesn't necessarily mean your strategy is failing. Take a step back and look at the bigger picture. Long-term trends are far more valuable than short-term fluctuations. This is especially true for B2B companies with longer sales cycles. Focusing only on monthly CAC can lead to panicked, short-sighted decisions that hurt your long-term growth.

Wrong Metrics: Chasing Vanity Numbers

Finally, many sales managers get caught up chasing vanity metrics. Sure, big numbers for website traffic or social media followers might look good, but they don't tell the whole story. How much does it actually cost to turn those engagements into paying customers? That's the question you need to answer. Focus on metrics that truly impact your bottom line. Looking at Customer Lifetime Value (CLTV) alongside CAC gives you a much clearer understanding of how profitable your acquisition efforts really are.

Ignoring these common mistakes can drain your marketing budget and stifle growth. Understanding your true CAC, taking a long-term view, and focusing on the right metrics are crucial for building sustainable, profitable growth.

Ready to ditch those cumbersome spreadsheets and take control of your lead management and customer acquisition process? Check out LeadFlow Manager, the all-in-one CRM designed for field sales teams.